douglas county nebraska car sales tax

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. The Nebraska state sales and use tax rate is 55 055.

Douglas County Treasurer S Office Omaha Ne

It is based upon the MSRP.

. Will become a dedicated driver licensing office for individuals needing to obtain or renew their drivers license or state identification card. The Nebraska state sales and use tax rate is. The location at 2910 N.

Douglas County is located in Nebraska and contains around 6 cities towns and other locations. 800-742-7474 NE and IA. The minimum combined 2022 sales tax rate for Douglas County Nebraska is.

The lessor will select Box 3 in the section titled Nebraska Resale or Exempt Sale Certificate for Motor. This is the total of state county and city sales tax rates. Nebraska Department of Revenue.

10 rows Douglas County Nebraska has a maximum sales tax rate of 75 and an approximate. The Nebraska sales tax rate is currently 55. The bill of sale must be.

The average effective property tax rate in Douglas County is just 063 which equates to a median annual property tax. The current total local sales tax rate in Douglas County NE is 5500. Original or copy of the front and back of the title or a copy of the bill of sale listing the date and time of vehicle sale notarized or signed under penalty of perjury.

Effective January 1 2023 the village of Byron will start a local sales and use tax rate of 1. A full list of these can be found. Registration Year Base Tax Amount 1.

161 rows ABRAMO JOSEPH C. Sales Tax 60000. Calculate Car Sales Tax in Nebraska Example.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. The Douglas Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Douglas local sales taxesThe local sales tax consists of a 150 city sales tax. As for zip codes there are around 44 of them.

Motor Vehicle Tax is assessed on a vehicle at the time of initial registration and annually thereafter until the vehicle reaches 14 years of age or more. 2915 NORTH 160TH STREET. The minimum combined 2022 sales tax rate for Douglas Nebraska is 55.

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. This is the total of state and county sales tax rates. The Nebraska state sales tax rate is currently.

The December 2020 total local sales tax rate was also 5500. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The Seller must also provide the buyer with a Bill of Sale or a completed Nebraska Department of Revenue Form 6 Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle And.

Sales tax cannot be paid on the cost of the motor vehicle at time of registration. Effective January 1 2023 the village of Sutherland will start a local sales and use.

Guide To Voting By Mail In Douglas County League Of Women Voters Of Greater Omaha

Douglas County Nebraska Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Motor Vehicle Driver License Umbrella Page Douglas County

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Eforms

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Douglas County Ne Businesses For Sale Bizbuysell

Vehicle And Boat Registration Renewal Nebraska Dmv

Omaha Scanner Douglas County Sheriff S Office Ne Facebook

Reneweble Water Resources To Front Range Project Archives Coyote Gulch

Douglas County Nebraska Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Douglas County Deputy Dave Wintle 51 Dies After Brief Illness Younger Deputies Looked Up To Him Local News Omaha Com

Tax Values Are Up Where Are The Biggest Increases In Douglas And Sarpy Counties

Omaha Scanner Douglas County Nebraska 911 Launches Facebook

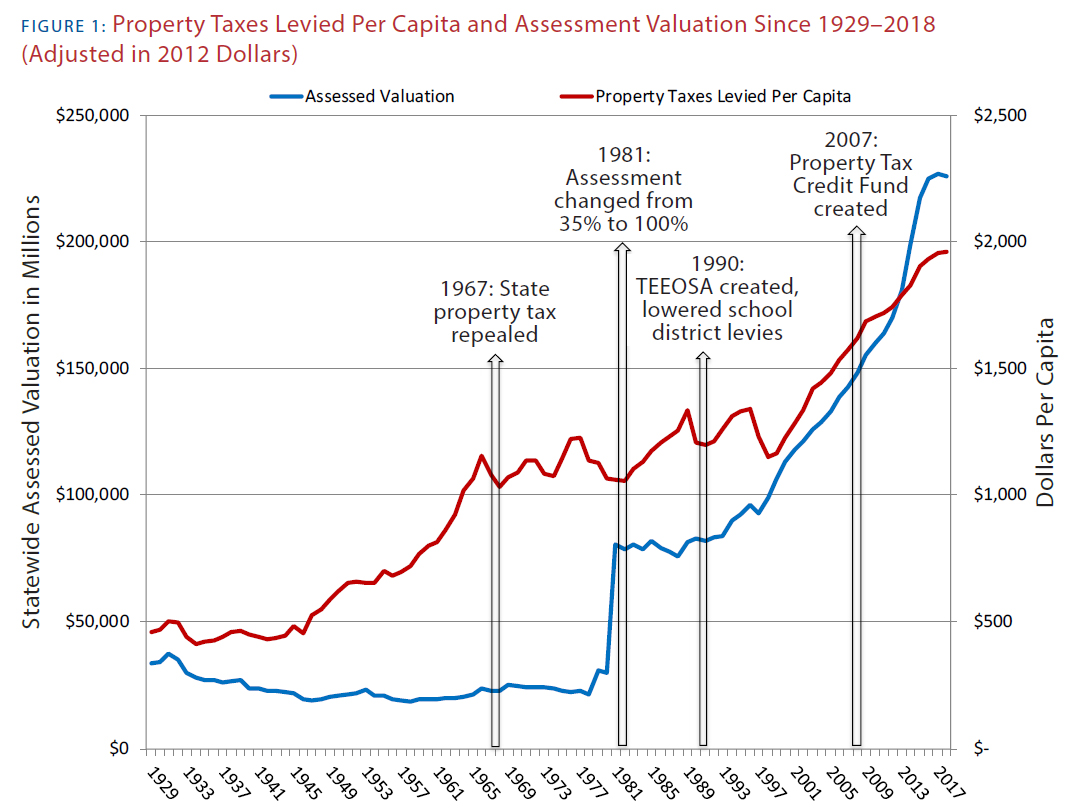

Get Real About Property Taxes 2nd Edition

Death And Taxes Nebraska S Inheritance Tax

Motor Vehicles Douglas County Treasurer

State S New License Plate Program In Effect Douglas County

Bellevue Police Will Receive 37 850 Pound Armored Vehicle For Rescues Local News Omaha Com